Introduction to E-Invoice HRDF Malaysia

The e-invoice system for the Human Resource Development Fund (HRDF) in Malaysia represents a significant advancement in the way companies interact with financial and operational processes related to training and development. E-invoicing is an electronic method for issuing and managing invoices that has gained traction as businesses transition towards digital practices. In this context, the e-invoice HRDF Malaysia serves as a crucial tool enabling organizations to streamline their invoicing processes associated with HRDF claims.

HRDF, established to support human capital development, allows organizations to claim training costs incurred for their employees. The introduction of e-invoicing enhances the efficiency of these transactions by facilitating real-time submission and tracking of invoices, thus reducing the potential for errors and delays often associated with traditional paper-based invoicing systems. As a digital solution, it enables finance and HR teams to consolidate their resources and exercise greater control over budgeting and expenses related to employee training initiatives.

Utilizing the e-invoice HRDF Malaysia system presents various benefits. First, it significantly enhances efficiency by expediting the approval process, allowing faster access to funds allocated for training. Moreover, the system minimizes administrative burdens by automating invoice submissions and integrating seamlessly with existing financial software. This not only reduces the time spent on invoice processing but also supports better cash flow management within organizations. Additionally, e-invoicing provides improved transparency, as both the HR and finance teams can easily monitor the status of claims and ensure compliance with HRDF guidelines.

In summary, e-invoicing is revolutionizing the submission process for HRDF claims in Malaysia, making it easier for organizations to manage their training expenditures while focusing on the development of their human resources.

Understanding HRDF and Its E-Invoicing Requirements

The Human Resource Development Fund (HRDF) is a Malaysian government initiative aimed at fostering the development of the workforce through training and skill enhancement. Established under the Pembangunan Sumber Manusia Berhad Act 2001, HRDF serves as a financial resource for both employers and employees to invest in employee training programs. The primary objective of HRDF is to enhance the overall quality and productivity of the Malaysian workforce, ultimately contributing to the country’s economic growth and sustainability.

As part of its aim to streamline operations and promote transparency, HRDF has implemented specific e-invoicing requirements. Understanding these requirements is vital for organizations seeking to submit an e-invoice to HRDF Malaysia effectively. E-invoicing is a digital method of billing that replaces traditional paper invoices and facilitates a more efficient transaction process. Compliance with these e-invoicing regulations is essential to avoid delays in the reimbursement of training grants and to ensure adherence to government policies.

The essential components of an e-invoice for HRDF submission include several crucial pieces of information. Firstly, details about the training program must be specified, including the program’s name, duration, and the number of employees who attended. Additionally, the invoice should clearly reflect the cost of the training sessions, aligning with the financial commitments stated in the initial funding approval. The e-invoice must also contain eligible recipient information, including the employer’s registration number and unique HRDF reference number. Ensuring that all these details are accurately incorporated in the e-invoice will facilitate a smooth compliance process with HRDF regulations.

In summary, understanding HRDF Malaysia’s e-invoicing requirements is key to navigating the complexities of submitting training-related claims. Being well-informed about these stipulations will aid in ensuring that organizations can effectively receive funding support for their workforce development initiatives.

Preparing Your E-Invoice for HRDF Submission

In order to successfully submit an e-invoice to the Human Resource Development Fund (HRDF) in Malaysia, it is critical to adhere to a structured preparation process. This ensures that all required documentation is meticulously organized and leads to a seamless submission experience. The first step involves gathering essential documents pertinent to the training program, which may include training details, participant information, and the actual invoices.

Before delving into the details of these documents, it is vital to understand the significance of providing accurate data. Any discrepancies or errors in the submitted data can result in rejections or delays, hindering the funding process. Thus, it is recommended that all information is cross-verified before submission.

The training details must outline the scope, objectives, and scheduled dates of the training session. This information is vital as HRDF calls for transparency regarding the programs they are funding. Participant information should include names, identification numbers, and contact details. Proper record-keeping on these aspects not only helps streamline the e-invoice submission process but also facilitates tracking and compliance with HRDF regulations.

Invoices need to be formatted correctly, adhering to the HRDF’s specific guidelines. It is crucial to include all necessary components such as the invoice number, date, total amount, and payment terms. Furthermore, it is advisable to specify the purpose of the invoice clearly, connecting it back to the training sessions attended by the participants when applicable.

In summary, preparing your e-invoice HRDF Malaysia involves meticulous gathering of training details, participant information, and invoices. The accuracy of data entry cannot be overstated, as it plays a pivotal role in ensuring that the submission process proceeds without any complications. Proper preparation can significantly enhance the chances of successful approval from HRDF.

Step 1: Logging into the E-Invoice HRDF Malaysia Portal

To initiate the process of submitting an e-invoice HRDF Malaysia, the first step involves securely logging into the HRDF Portal. This is a crucial stage in ensuring that your e-invoice submission is processed smoothly. If you already possess login credentials, simply navigate to the HRDF Portal’s official website. You will be greeted by a login screen that requires you to enter your username and password. Ensure that you have a secure internet connection to protect your sensitive information.

In case you cannot recall your login details, the HRDF Portal provides a user-friendly option to retrieve forgotten credentials. Look for a ‘Forgot Password’ link on the login page. Upon clicking this, you will be prompted to enter the email address associated with your account. A reset link will be sent to your inbox, allowing you to create a new password. For users who haven’t registered yet, an account can be created easily by clicking on the ‘Register’ or ‘Sign Up’ button on the portal’s homepage. Following the subsequent instructions will guide you through the registration process, which typically requires personal and company information.

Once registered, you will receive a confirmation email with your login details. Be sure to keep these credentials secure to prevent unauthorized access. Additionally, leveraging two-factor authentication (if available) can enhance your account security further. After successfully logging in, users will gain access to various features of the portal, including submitting and managing e-invoices. This seamless navigation is vital for efficient HRDF compliance, ensuring that all submissions are completed timely. Taking these initial steps lays the groundwork for a successful e-invoice submission process.

Navigating to the E-Invoice Submission Section

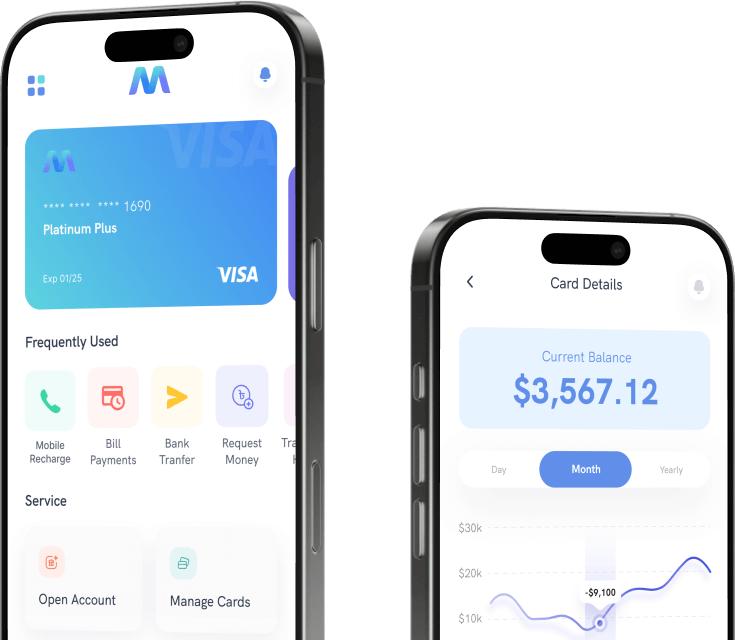

To successfully submit your e-invoice HRDF Malaysia, it is essential to familiarize yourself with the HRDF Portal’s layout. Start by visiting the HRDF official website. Once on the homepage, look for the login section, typically located at the top right corner of the page. Enter your credentials – your username and password – then click the “Login” button to access your account. If you are a new user, ensure you have completed the registration process to generate your login details.

Upon entering the portal, you will encounter a dashboard featuring various options such as “Dashboard,” “Applications,” “Reports,” and “E-Invoice Submission.” The e-invoice section is directly related to your HRDF contributions, and clicking on it will navigate you to the invoicing interface. Depending on your account type or specific role within the organization, the interface may vary slightly but generally remains consistent.

Once you have selected “E-Invoice Submission,” you may be directed to a new page with detailed guidance on submitting your invoices. Here, you should find resources such as e-invoicing templates, submission guidelines, and an FAQ section addressing common queries. Additionally, you might see a table listing previously submitted invoices, which could help you track your submissions and manage your documentation efficiently.

For visual support, consider reviewing any diagrams or screenshots provided within the portal’s e-invoice section. These resources are specifically designed to aid users in quickly locating the necessary options and forms for e-invoicing, ensuring that the process is as seamless as possible. Understanding how to navigate through these steps will facilitate timely and accurate submissions, thereby enhancing your compliance with HRDF regulations.

Entering E-Invoice Details

Once the preliminary steps are completed, the next critical phase in the e-invoice HRDF Malaysia submission process is the actual entering of e-invoice details. This process requires meticulous attention to detail, as each field in the submission form plays a vital role in ensuring a successful submission.

The submission form typically includes several fields that you must fill in with accurate information. Key fields on the form include the invoice number, date of issuance, vendor details, and the description of the goods or services provided. It is essential that the invoice number is unique to avoid duplication and ensure proper tracking of the transaction. The date of issuance should reflect the actual date when the invoice was generated.

Next, the vendor details must include their legally registered name, business registration number, and contact information. Accuracy in this section is paramount, as any discrepancies could lead to rejection of the e-invoice submission. The description field typically requires a detailed yet concise account of the services or goods supplied. Best practices recommend you clearly delineate the items, including their quantities and unit prices, to provide a comprehensive overview of the transaction.

Furthermore, ensure that all amounts are correctly calculated and reflect any applicable taxes. It is advisable to double-check the total amounts to avoid errors that could impede the processing of your e-invoice. Consider using a systematic approach, perhaps cross-referencing with other financial documentation related to the invoice to bolster accuracy. Submitting a well-structured invoice not only facilitates a smoother transaction but also fosters a positive relationship with the HRDF and the parties involved.

In conclusion, by carefully completing each field of the e-invoice submission form, you can considerably enhance the efficiency of the e-invoice HRDF Malaysia process and reduce the chances of errors that may delay approval.

Step 4: Uploading Supporting Documents for E-Invoice HRDF Malaysia

In the process of submitting an e-invoice for HRDF Malaysia, it is crucial to ensure that all supporting documents are appropriately uploaded. Supporting documents may include essential items such as training certificates, attendance lists, and any other documentation that bolsters the legitimacy of the e-invoice process. The submission of these documents is vital for HRDF verification and approval.

To begin uploading your supporting documents, you will first need to log in to the HRDF portal using your registered credentials. After logging in, navigate to the section where you can submit your e-invoice. Within this section, there will typically be an option to attach files or upload additional documents. Ensure you locate this option before proceeding.

When uploading, it is essential to follow the specified guidelines regarding file formats and size restrictions. HRDF Malaysia generally accepts documents in common formats such as PDF, JPEG, or PNG. Before uploading, verify that the file names and formats adhere to the portal’s requirements. Additionally, take note of the maximum file size limit for uploads, which is usually indicated on the submission page. Typically, documents should not exceed a certain number of megabytes to avoid upload errors.

It is advisable to prepare all necessary documentation in advance, ensuring that they are clear, legible, and well-organized. Upload each document following the prompts provided by the HRDF system. After uploading, review to confirm that all files have been accurately submitted. Remember to check for any confirmation messages indicating successful uploads, as this will ensure that your e-invoice submission is complete and ready for processing.

Step 5: Reviewing and Submitting Your E-Invoice

Before submitting your e-invoice HRDF Malaysia, it is crucial to conduct thorough reviews of both the e-invoice and any supporting documents. This step ensures all information is accurate and compliant with HRDF requirements. Begin by verifying the details in your e-invoice, including the invoice number, dates, recipient information, and item descriptions. Confirm that the amounts charged correctly reflect the services rendered. Inaccuracies at this stage could lead to delays in processing or payment, which can impact financial planning.

Next, check the supporting documents such as contracts, service agreements, or previous correspondence related to the transaction. These documents provide context and validation for the charges listed in your e-invoice. Ensure that these are up-to-date and that all necessary documentation is attached to your submission. It can also be helpful to create a checklist that includes all required pieces of information, which will serve as an efficient template for future submissions. This practice can significantly reduce oversight and enhance compliance.

Once you have thoroughly reviewed your e-invoice HRDF Malaysia and confirmed that all information is accurate, the next step is submission. Log in to the HRDF portal and navigate to the e-invoice submission section. Follow the prompts to upload your documents. Before finalizing your submission, double-check that all files are correctly uploaded and in the appropriate format. Submitting the e-invoice is the last step in the process, so it is paramount to ensure that everything is in order to avoid complications. This meticulous attention to detail fosters a smoother transaction experience and aids in achieving timely reimbursement.

Troubleshooting Common Issues with E-Invoice HRDF Malaysia

Submitting an e-invoice under the HRDF Malaysia framework can sometimes lead to unexpected challenges. Understanding and resolving these issues promptly is essential to ensure successful submissions. Below, we discuss common problems users may encounter with e-invoice submissions and provide practical solutions.

One prevalent issue is the failure to adhere to the required format. HRDF Malaysia mandates specific template guidelines for e-invoices. Users must ensure that they are using the most current templates provided by HRDF. If submissions are rejected due to formatting errors, it is advisable to download the latest version of the template from the HRDF website and carefully follow the outlined instructions for completing the fields.

Another common problem is an incorrect or mismatched Tax Identification Number (TIN). When completing the e-invoice, double-check that the TIN matches the registered business information in the HRDF database. Discrepancies can lead to processing delays or rejections. If TIN-related issues occur, it is beneficial to verify the registration details with the HRDF system or reach out to HRDF support for confirmation.

Technical errors may also hinder submission attempts. Users may experience system outages, slow uploads, or unexpected error messages. In such cases, it’s recommended to refresh the webpage or try submitting at a different time. If the problem persists, consult the HRDF technical support team, which can provide assistance on resolving backend issues.

Lastly, ensure that all required fields are completed accurately before submission. Incomplete e-invoices can lead to automatic rejections. It’s best practice to review the invoice thoroughly for missing information, inconsistencies, or typos. Adopting a checklist approach when preparing e-invoices can significantly reduce the likelihood of encountering such errors.

By addressing these common issues effectively, HR and finance teams can simplify the e-invoice submission process and maintain compliance with HRDF Malaysia’s requirements.